Julius Baer Edelweiss Swiss Equity– a sub fund of Premium Selection UCITS ICAV

SFDR Disclosures – Effective 10/06/2024

Summary Document

A Summary document of the main features of the Fund is available to download from this page. Translations into the official language of the EU jurisdictions into which the Fund is distributed are also available.

Sustainable Investment Objective

The Fund promotes environmental or social characteristics but does not have as its objective a sustainable investment.

Environmental/Social Characteristics of the Fund

The Fund promotes the following environmental and social characteristics:

- Climate change mitigation and adaption;

- Preservation of biodiversity;

- Sound employee conditions;.

- Respect of global norms standards.

To ensure that the Fund maintains its ESG profile the Fund is required to invest in instruments that comply with the Investment Manager’s proprietary Sustainable Investment Rating Methodology thresholds, where the scale used for the Investment Manager’s thematic scores is -3 (very weak) to +3 (very strong):

JB Climate Score ≥ -1 Exclusion of weak and very weak performers

JB Natural Capital Score ≥ -1 Exclusion of weak and very weak performers

JB Global Norms Score ≥ -1 Exclusion of weak and very weak performers

JB Human Capital Score ≥ 0 Average or better performance

Thematic s cores

The Climate Score addresses the question of greenhouse gas emissions and an investee company’s exposure to the shift towards a net-zero world. The basis of the Climate Score is scope 1 and scope 2 carbon emission intensity (which are principal adverse impact indicators) representing carbon emissions scaled to an investee company’s size. The Climate Score also considers the negative impact of investee companies active in the fossil fuel industry. For example, if an investee company generates a significant part of its revenue from coal-related activities, they would be assessed for a potential downgrade in their Climate Score.

The Natural Capital Score addresses the topics of biodiversity, air pollution and other pollution, and allows for identifying companies with a significant exposure to, and impact on, environmental issues beyond climate. The basis of the Natural Capital Score consists of different attributes associated with the general concept of natural capital, such as an investee company’s natural resource stocks and usage. For this purpose, the Investment Manager considers different elements such as: the raw materials an investee company uses and how these are sourced; an investee company’s waste management systems; environmental impact and prevention policies; and water management practices including the water intensity and water stress in their operations.

The Global Norms Score focuses on investee companies’ operations and their compliance with globally accepted norms of human rights, labour rights, and responsible business practice. In calculating the Global Norms Score, the Investment Manager considers compliance by investee companies with the UN Global Compact, child labour and the United Nations Guiding Principles for Business and Human Rights. In addition, the Global Norms Score scrutinises the involvement of an investee in weapons, both conventional and controversial. Any involvement in controversial weapons leads to an ESG Risk investment classification under the Sustainable Investment Methodology (defined below).

The Human Capital Score covers employee conditions and development, workplace policies, such as pay, secondary benefits, health and safety guidelines, workplace policies in relation to diversity, inclusion, knowledge and skills development, and the prevention of harassment. In addition, an investee company’s impact on a broader group of stakeholders, such as emissions and pollution produced by operations affecting neighbouring communities is considered.

Investment Strategy for the Fund

The Fund primarily invests in shares of Swiss companies, which are listed in the SPI and denominated in CHF. It is expected that the investable universe will be about 80-100 stocks. The portfolio mainly comprises of two asset classes, namely cash and equities and is almost exclusively built from single stocks. The Fund invests in large, mid and liquid small cap companies. The focus of the Investment Manager is on high quality compounders (with high profitability, sound balance sheet, potential for growth etc.). The stock selection is done using a traditional bottom-up approach, i.e. investment decisions are taken on the basis of individual assessments taking into consideration qualitative and fundamental analysis, which includes historical and future company assessments as well as valuation models and technical analysis.

The Investment Manager then evaluates historical profitability by analysing the investee company ROIC (return on invested capital) and free cash flow. The investee company balance sheet is also reviewed. Historical earnings growth, including earnings drivers and recent earnings revisions, are then reviewed to allow the Investment Manager to understand the drivers of the investee company’s earnings power. As part of its instrument selection process, the Investment Manager applies its proprietary Sustainable Investment Rating Methodology (the “Sustainable Investment Methodology”).

Methodologies used to measure the attainment of the social or environmental characteristics promoted by the Fund

The Fund promotes environmental or social characteristics by investing in instruments that comply with the Investment Manager’s proprietary Sustainable Investment Rating Methodology (the “Sustainable Investment Methodology”). The Sustainable Investment Methodology is structured at three levels:

(i) The first level is to gather unprocessed ESG data from various external data providers, as well as internal thematic research related to investment themes that are linked to sustainable objectives;

(ii) Then certain thematic scores are calculated out of the unprocessed ESG data and internal thematic research;

(iii) At the final level, four different ESG categories are derived using a combination of the thematic scores and certain indicators (processed ESG data such as ratings) provided directly by various ESG data providers.

The four ESG categories derived from the process are “ESG Risk”, “Traditional”, “Responsible” and “Sustainable”. The thematic scores are calculated at the second level of the process and comprise of the Environmental scores, Social scores and the Governance core. The Environmental scores are the Climate Score and the Natural Capital Score. The Social scores are the Human Capital Score and the Value Score. t. The Global Norms Score measures if an investee company is involved in the production and/or sale of conventional weapons and how it complies with global norms standards. The Governance Score addresses the question of an investee company’s business behaviour, in its pure definition, i.e., in terms of policies, organisation structures, ethics, code of conduct, or accountability. The thematic scores are determined based on available data. Their values range between 3 to -3.

For an instrument to be categorised as Responsible, the issuing investee company should have at least a Governance Score of zero (0). At the same time, for an instrument to be categorised as Sustainable under the Sustainable Investment Methodology, the issuing investee company would generally have at least a Governance Score of one (1). The final categorisation of each instrument to each of the ESG categories is based on a combined consideration of thematic scores. In order for a financial instrument to receive a Responsible categorisation, the thematic scores as well as the processed ESG data (such as ratings) need to be at a level that confirms to the Investment Manager that the financial instrument has clear ESG characteristics and does not show a clear weakness on any of the indicators considered. In particular, the relevant investment would need to achieve a Governance Score of at least zero (0), a Climate Score of at least minus one (-1 ), a Natural Capital Score of at least minus one (-1 ), a Global Norms Score of at least minus one (-1 ), and a Human Capital Score of at least zero (0), thereby ensuring weak and very weak performers are excluded, noting the scale used for the Investment Manager’s thematic scores is -3 (very weak) to +3 (very strong).

To receive a Sustainable categorisation, the requirements are higher and ensure that a financial instrument needs to show at least average values on all indicators considered, as well as above average strength on some of the indicators considered. In particular, the relevant investment would need to achieve a Governance Score of at least one (1), a Climate Score of at least one (1), a Natural Capital Score of at least zero (0), a Global Norms Score of at least zero (0), and a Human Capital Score of at least one (1).

When it comes to the ESG Risk category, if certain indicators related to controversies, controversial activities, violations of global norms or materially negative sentiment related to ESG aspects indicate that a financial instrument has clear issues that point to substantial risks related to ESG, a financial instrument will receive the ESG Risk categorisation, unless the Investment Manager’s Responsible Investment Committee (“RIC”) overrides this categorisation and decides to classify the instrument as Traditional. The RIC has been established by the Investment Manager as its internal governance body in relation to the Sustainable Investment Methodology that the Investment Manager has developed. The RIC comprises two panels: the RIC Strategic Panel (the “S-RIC”), which decides on the ESG investment and offering strategy, governance and methodology, and the RIC Operational Panel (the “OP-RIC”) that operates based on a delegation granted by the S-RIC and monitors the application and overall functioning of the Sustainable Investment Methodology on an instrument and/or issuer level within the Investment Manager’s day-to-day operations. Among other duties, the OP-RIC handles the exception requests in relation to the ESG status category of financial instruments. An upgrade of an ESG Risk-categorised instrument, or the upgrade or downgrade of an instrument categorised as Sustainable, Responsible or Traditional, can be requested by the portfolio and/or risk management team within the Investment Manager based on sound arguments and/or evidence, e.g., ESG reports from other rating- or data providers than the ones normally used by the Investment Manager, or a properly minuted discussion with the issuer, also involving the Investment Manager’s research team. The OP-RIC will review the request and the arguments provided and if they find them to be sound and supported, it is within its power to grant an exception and upgrade the instrument under consideration from the ESG Risk-categorisation to a Traditional-categorisation or upgrade or downgrade an instrument categorised as Sustainable, Responsible or Traditional.

Lastly, a financial instrument that is neither ESG Risk nor Responsible nor Sustainable, will be categorised as Traditional. This is the remaining category and can be seen as the default value for an instrument that does not have substantial ESG issues leading to an ESG Risk categorisation, but also no specific ESG characteristics leading to a Responsible categorisation. Traditional can be seen as the neutral value.

The Fund will not invest in ESG Risk-categorised instruments unless an exception has been granted by the Investment Manager’s Exception Committee.

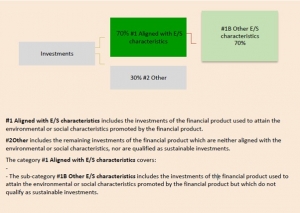

Proportion of Investments with Environmental/Social Characteristics

At a minimum 70% of the Fund’s assets must always be invested in financial instruments categorised by the Investment Manager as Responsible or Sustainable. The remaining 30% can be invested in financial instruments categorised as Traditional or in financial instruments that do not have an ESG category assigned by the Investment Manager. ESG Risk-categorised financial instruments are not permitted unless the Fund has been granted an exception by the Investment Manager’s Exception Committee.

Binding Elements of the Investment Strategy

The Fund promotes environmental and social characteristics by investing:

- At least 70% of the Fund’s assets in financial instruments categorised by the Investment Manager as Responsible or Sustainable.

- The remaining 30% in financial instruments categorised as Traditional or

- In financial instruments that do not have an ESG category assigned by the Investment Manager.

- In any instrument approved by the Exception Committee.

The Fund does not have a sustainable investment objective and therefore does not commit to making any sustainable investments within the meaning of SFDR. The Exception Committee has been established by the Investment Manager as its internal governance body that may grant an exception for an instrument that is categorised as ESG Risk to remain in the portfolio of the Fund and such exception will be valid on a fund-specific basis only. The instrument will remain categorised as ESG Risk but an exception granted for the Fund to remain invested would be driven by the specific nature of the Fund. For example, if an instrument becomes classified as ESG Risk after holding it in the Fund, but it is found that a disposal would not make sense as it may be detrimental to Shareholders or contradict the purpose of the Fund.

Monitoring of the Environmental/Social Characteristics

In accordance with the SFDR, the Investment Manager has implemented the assessment of Sustainability Risks within the investment decision-making process for the Fund, both at the initial due diligence stage of the investment process and as part of the ongoing monitoring of the Fund’s investments. However, while the Fund promotes environmental or social characteristics, it does not have a Sustainable Investment objective.

The integration of Sustainability Risk assessments to actual investment decisions aims to ensure that Sustainability Risks are considered similarly to all other risks that are integrated in the investment decision-making process. The Sustainability Risk factors used to determine whether companies are in a position to effectively manage Sustainability Risks linked to ESG scores, themes and trends (e.g., ESG ratings, violations of global norms, media sentiment around ESG issues, indicators related to child labour and other such controversies) can be of both a qualitative and quantitative nature and are derived from multiple internal and external data sources and/or internal research and analysis, where available. Within the investment decision-making process, the Investment Manager integrates Sustainability Risks by the assessment and corresponding exclusion of companies, which are deemed to bear a high Sustainability Risk.

Limitations to data and methodologies

Assessment of Sustainability Risks is complex and may be based on ESG data provided by external data providers based on the data providers’ proprietary methodologies. ESG data including ratings may not be accurate, complete, up-to-date and/or continuously available and, in particular, for certain issuers, may be difficult to obtain, depending on the level of transparency of the issuer and publicly available information. Shareholders and potential investors shall note that the assessment of Sustainability Risk does not mean that the Investment Manager aims to invest in assets that are more sustainable or even avoid investing in assets that may have public concerns about their sustainability. Such integrated assessment shall consider all other investment criteria and factors taken into account by the Investment Manager and it can e.g., be deemed by the Investment Manager that a recent event or condition may have triggered an overreaction in the market that has had an exaggerated bearing on the market value of a potential or existing asset of the Fund. Similarly, a holding in an asset subject to such negative impact does not mean that the asset would need to be liquidated.

Due Diligence Process and engagement

Any Collective Investment Scheme (CIS) to be considered for investment is firstly subject to due diligence by the Investment Manager’s fund research analysts, resulting in a buy-list of approved funds covering all asset classes, regions and specific themes. These buy-lists will be used by the Investment Manager who will then select the individual CIS for investment by the Fund at its discretion, following the same process and methodology as it applies to all investments and securities selections to get exposure to the various asset classes represented in the tactical asset allocation of the Fund. Where the Investment Manager identifies additional CIS not being on the buy-list, an individual due diligence and assessment is being made applying the same approach as for the approved funds on the buy-list which is then presented and approved by the Investment Manager’s Exception Committee, which is a committee comprised of senior members of the Investment Manager’s portfolio management team, on an individual basis prior to an investment by the Fund.

Good governance by investee companies is managed through reducing risk by eliminating companies with poor governance, such as companies that display controversies, unethical behaviour, bribery or corruption. In particular, good governance is ensured through the Investment Manager’s proprietary Governance and Human Capital scores. The Governance Score addresses investee companies’ business behaviour in relation to their organisation and management structures, business ethics, accountability, and tax compliance. The Human Capital Score assesses companies in relation to employee conditions and labour management, covering aspects such as workplace policies in relation to diversity and inclusion, health and safety, and the prevention of harassment.

Impact of Sustainability Risks on the returns of the Fund

Sustainability Risk factors are generally mid to long-term investment risks, that can also materialise in the short-term. They may materialise along any of the three dimensions: environmental, social and/or governance risks. As an example, Sustainability Risks may materialise as issuer-specific extreme loss-risks. Such issuer-specific Sustainability Risk events typically happen with low frequency and probability but may have high financial impact and may lead to significant financial loss for the Fund. Additionally, Sustainability Risk could materialise through changes in public sector policies (e.g., carbon taxation), innovation and/or investor and consumer sentiment towards a greener environment.

The results of the assessment of the likely impacts of Sustainability Risks on the returns of the Fund indicate that the Fund is likely to be less impacted by such risks than the Fund’s investment universe and that the Fund will experience lower volatility caused by such risks than the wider market generally.

The Investment Manager acknowledges that the Fund’s exposure to Sustainability Risks is evolving over time and shall keep the Fund’s exposure to these risks under monitoring. Where the Investment Manager considers, as a result of such a review, that the Fund’s exposure to Sustainability Risks has materially changed, these disclosures will be updated accordingly.

Principal Adverse Impacts

The Investment Manager and the Manager will not be considering the potential adverse impacts of investment decisions on Sustainability Factors for this Fund at present. As the Fund does not promote environmental or social characteristics or have Sustainable Investment as its objective, it has been decided that the Investment Manager and the Manager will not seek to measure such adverse impacts on Sustainability Factors.

The Investment Manager and the Manager have not implemented a general Sustainability Due Diligence Policy at entity level to measure the principal adverse impacts of investment decisions on Sustainability Factors. Due to the lack of clear, reliable and structured data on the adverse impacts from issuers, investee companies and data providers at this point in time, the Investment Manager and the Manager consider that the available data on this topic is currently not sufficiently mature to consider such factors in a comprehensive and coherent manner for all financial products they manage.

Benchmark

The Fund is actively managed by the Investment Manager and the Fund is not constrained by reference to any index.

The Fund uses a benchmark, MSCI Switzerland Net Total Return Local Index (the “Benchmark”), for performance comparison purposes only and the Investment Manager has broad discretion to deviate from the Benchmark’s constituents, weightings and risk characteristics within the Fund’s objective and investment policy. The degree to which the Fund may resemble the composition and risk characteristics of the Benchmark will vary over time and the Fund’s performance may be meaningfully different from, or more closely aligned with, that of the Benchmark.

The Benchmark is designed to measure the performance of the large and mid cap segments of the Swiss market. With currently 45 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in Switzerland.

The Investment Manager believes that the Benchmark is appropriate for the Fund as the constituents of the Benchmark are substantially consistent with those of the equity-investment universe of the Fund and the Fund`s asset allocation.

The list of benchmark administrators that are included in the Benchmarks Regulation Register is available on ESMA’s website at www.esma.europa.eu. As at the date of this Supplement, the following benchmark administrator is availing of the transitional arrangements afforded under the Benchmarks Regulation and, accordingly, does not appear on the Benchmarks Regulation Register: MSCI Limited.

Further details on the investment strategy employed by the Investment Manager to achieve the Fund’s sustainable investment objective can be requested via – https://www.threerockcapital.com

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary CZ

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary DA

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary DE

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary EL

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary ES

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary FI

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary FR

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary IT

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary NL

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary SK

Julius Baer Edelweiss Swiss Equity sub-fund CHF Summary EN